New report seeks the defining metrics of Dynamics NAV and Business Central manufacturing customers

When manufacturers invest in a new ERP solution, they can reap the benefits (or deal with the consequences) for years to come. And with so many competing options, from the latest cloud-based solutions at one end to Excel at the other, buyers can be justified in feeling some uncertainty as they try to make an informed decision. A new survey seeks to understand the views and choices of manufacturers that have chosen to run Microsoft Dynamics NAV and Dynamics 365 Business Central and the partners who support them.

The survey and resulting report, The State of Microsoft Dynamics 365 Business Central & Manufacturing, created by Microsoft partner NETRONIC, seeks to answer some seemingly basic questions that often seem unknowable to the community. The survey asked about the type of manufacturing work done with these ERPs, the choice between cloud and on-premises ERP, legacy solutions, views on customization, and more.

Responses from both customers and partners show that these groups often see eye-to-eye, but attitudes vary in some important areas. 52 NAV and BC customers and 266 partners participated, and the report segmented users on several dimensions.

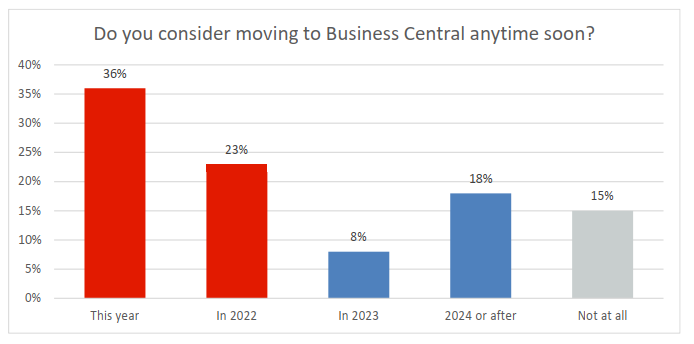

Future plans

This survey's customer participants were a mix of NAV veterans and newer BC customers. More than two-thirds reported using the software for more than 3 years and 39 percent with more than 8 years of experience. Twenty-two percent had been using Business Central for less than a year.

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here