Beyond the Basics: Posting Inventory Purchases the Righter Way in Business Central

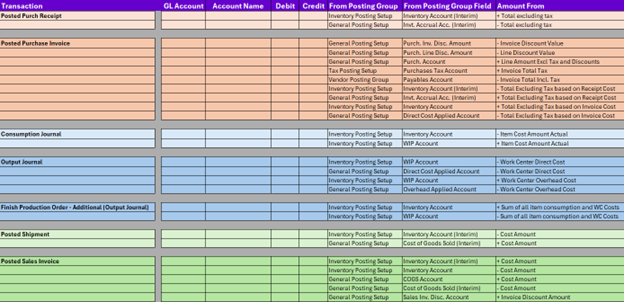

Inventory accounting in Microsoft Dynamics 365 Business Central is full of nuance, and nowhere is this more evident than in how the system handles inventory purchases. It’s easy to get caught up in the mechanics of getting transactions to post, but real value comes when we understand why those postings occur the way they do and how we can use them to inform better business decisions.

In this article, I’ll break down how Business Central handles expected vs. actual inventory costs, why separating the Purchase Account from the Direct Cost Applied Account matters, and how this structure supports the creation of a supplemental inventory value statement. This is a practical guide for financial and operations users alike who want to move beyond compliance and into meaningful insight—the Righter Way.

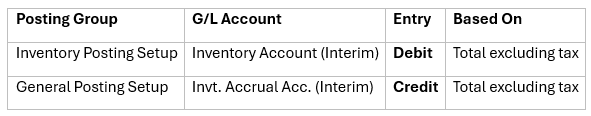

Step One: Expected Costs When Inventory is Received

When you receive inventory but haven’t yet posted the vendor invoice, Business Central records expected costs. These are temporary entries designed to reflect the anticipated increase in inventory value and liability without yet impacting your permanent accounts.

Here’s what gets posted:

This expected entry is reversed later, when the vendor invoice is posted with actual costs.

Step Two: Actual Costs When the Invoice Is Posted

Once the invoice arrives and is posted, Business Central:

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here