AI Agents in Business Central: What Warehouse & Finance Teams Should Know

Warehouse managers and finance teams often operate in parallel silos. The warehouse is watching stock levels, shipments, and returns. Finance is balancing payables, receivables, and month-end closes. Yet when both areas are disconnected, bottlenecks form: late invoices, mismatches in inventory cost, delayed reconciliations, and loss of discounts.

With the latest version of D365 Business Central, Microsoft has introduced AI-powered agents such as the Payables Agent and the Sales Order Agent that can change the game. These AI agents automate routine tasks, reduce manual effort and enable teams to focus on value-driving work instead of data entry and reconciliation.

In this article we’ll explore:

- What AI agents in Business Central are and how they work.

- What warehouse and finance teams specifically should know.

- Key benefits and use-cases.

- Implementation considerations you should both be aware of.

What are AI Agents in Business Central?

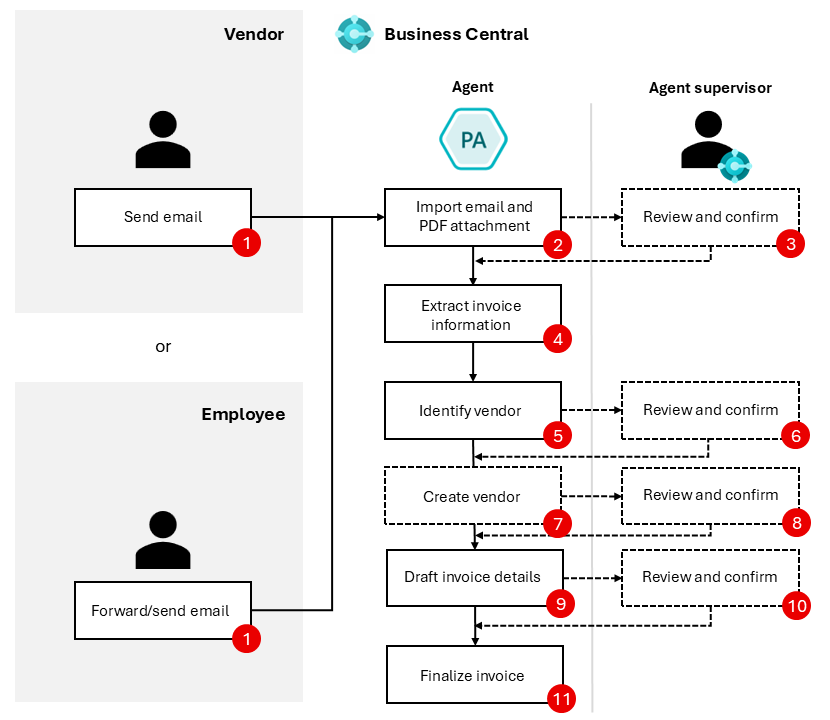

An AI agent in the context of Business Central is more than a simple automation rule. It is a semi-autonomous piece of software embedded in the ERP system which:

- Monitors inbound documents or data (for example vendor invoices arriving via email).

- Employs intelligent extraction and matching (for example using Azure Document Intelligence in the case of the Payables Agent).

- Drafts or posts documents (with human review when needed) inside the Business Central ledger.

- Integrates with the wider Microsoft ecosystem (Copilot, Power Platform, etc.).

For warehouse teams this means the ripples go beyond finance: inventory cost changes, receipt variances, inter-company stock flows all impact the bottom line. For finance teams it means fewer manual steps, faster posting, better control and improved visibility.

Sales Order Agent: Order Intake Automation

The Sales Order Agent in Business Central takes the lead in order capture and automates how customer orders are processed via email. When a customer sends a request to a monitored mailbox, the agent identifies the customer, finds the items, checks availability, drafts a sales quote, sends it for approval, and then converts it into a sales order—all embedded within Business Central.

Why Warehouse & Finance Teams Should Care AI

1. Streamlining Invoice and Stock Receipt Workflows

Warehouse operations rely on timely data: goods receipts need to match purchase orders, invoices need to be processed so that stock cost is recognised, and material flows are properly accounted. The Payables Agent helps ensure vendor invoices follow the goods movement. For example, when an invoice arrives, the agent extracts the data and suggests the correct vendor, account codes and so on. This reduces delays and mismatches.

2. Better Visibility and Control Across Functional Teams

When warehouse and finance use the same ERP system (Business Central) and the same AI agents, data flows more efficiently. Finance gets up-to-date visibility of costs tied to inventory movements; warehouse can see pending payables or approval delays impacting shipment/receipt accruals. This level of collaboration means fewer surprises and smoother operations.

3. Error Reduction and Compliance

Manual invoice processing and matching brings risk: wrong accounts, missing cost allocations, duplicate payments. The AI agent’s capabilities in Business Central include vendor identification, line‐item extraction, and generating drafts for review. For warehouse and finance teams this builds a stronger control framework—especially in multi-entity or multi-warehouse scenarios.

4. Scaling Without Proportionate Headcount Increase

As businesses grow—adding warehouses, suppliers, entities—manual processing doesn’t scale easily. AI agents enable warehouse and finance teams to support higher volumes of invoice/receipt data and inventory flows without hiring more staff.

Key Features & Use-Cases

| Feature | Use-Case in Warehouse & Finance | Description |

|---|---|---|

| Mailbox-to-Invoice Automation | A supplier sends PDF invoice to central mailbox; agent picks up, extracts vendor & amount, creates draft in BC | The Payables Agent monitors mailbox and uses automated extraction. |

| Matching & Validation | Invoice arrives for warehouse stock; agent matches invoice to PO/receipt so warehouse cost is properly captured | Matching capabilities reduce manual intervention. |

| Approval Routing & Exception Handling | Large or unusual invoices automatically routed to finance controller; small ones auto-posted | Improves processing speed while maintaining control. |

| Integrated Dashboards and Alerts | Warehouse manager sees invoice exceptions pending, finance sees pending AP liability by warehouse | Both teams have aligned metrics and visibility. |

| Scaling Multi-Company Workflows | A business with several entities uses one solution; agent applies same logic across entities | Standardises processes and reduces variance. |

Implementation Considerations for Warehouse & Finance Teams

Data Readiness: Vendor master data, cost-centre codes, warehouse entity setup, inter-company flows all need to be well-defined. If data is fragmented, AI agent performance suffers.

Change Management: Warehouse and finance teams must align around new workflows. Finance staff shift from manual processing to exception review; warehouse teams must coordinate receipt timing and data integrity.

Integration & Customisation: Since Business Central agents may be impacted by extensive customisations, both teams should ensure the solution remains as standard as possible to avoid issues.

Permissions & Governance: Admins must set up proper permissions for the agent, define which mailboxes it monitors, which entities it operates in and which roles review exceptions.

Pilot Approach: Start small (e.g., overhead invoices or a single warehouse entity) to test the agent, refine exceptions, measure metrics—then scale across the business.

KPI-Tracking: Agree KPIs that both warehouse & finance teams care about—invoice cycle time, cost per invoice, exceptions ratio, stock cost variances, inter-company clearance times.

What this Means for You Now

If you’re monitoring warehouse metrics in Excel and processing invoices manually, now is the moment to review whether your ERP supports AI-agent workflows.

Warehouse teams should engage with finance early: ensure the receipt → invoice → cost capture chain is mapped and the agent logic covers it.

Finance leaders should prepare the business case: reduced manual cost, faster posting → improved cash-flow visibility → fewer surprises.

Keep in mind: The agent features in Business Central are in preview and may need configuration and readiness before full rollout.

Conclusion

For warehouse and finance teams in wholesale or trade environments, AI agents within Business Central mean more than just automation—they mean alignment, insight, speed and scalability. When both teams use the same intelligent workflows and data, the business operates stronger and smarter.

If you’re ready to explore how AI agents can streamline your invoice and receipt workflows, align warehouse and finance seamlessly, and improve control across entities—book a discussion with our Business Central specialists today.