The search for Dynamics 365 Business Central Data Exchange Definitions to match major Canadian bank EFT requirements

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here

This article is a bit different from what you normally see from me. It is a story about not being able to fulfill a customer’s requirement for electronic banking using standard Dynamics 365 Business Central functionality. Yes, you heard me correctly. So, what did I do to fill the gap in BC functionality for this customer?

What is different from the norm about this customer’s electronic banking requirements?

The customer I was helping is a United States based business. They were in the process of selecting a Canadian bank in support of their business efforts in that country. With forethought, they decided to learn what it might take to meet EFT (Electronic Funds Transfer) requirements for any bank they were considering.

I suggested that they get whatever they could from each bank related to EFT guidelines including file examples if possible. What they found was that the formats provided were very different from the ACH formats used in the US, so they asked again for my help to determine if BC could meet the requirements out-of-the-box.

Checking Data Exchange Definitions for Canada in Business Central

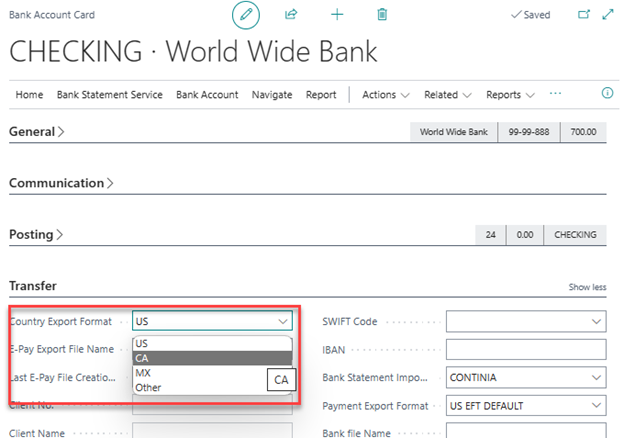

The first thing I did was to remember that on the Transfer FastTab of the Bank Account, there is a field for selecting a Country Export Format. The options in the North American localization include US, CA and MX. Selecting CA as our option sets us off to a good start.

After setting up this field and the others I need on the bank account and vendor bank account cards to export payments, I went to Data Exchange Definitions to find an example for a Canadian payment export. I selected CA EFT DEFAULT and assigned it to the Bank Export/Import Format selected on my Canadian Bank Account. I generated a test file through the payment journal. I now had something to compare to the samples provided to my customer from TD Bank of Canada and RBC Express.

The results of test file comparisons

Unfortunately, the output from the available Data Exchange Definition in BC only matched one example provided by the banks. I didn’t think that an EFT file format should be a major deciding factor in selecting a bank for your business, so I started to look for another way to meet the EFT file format requirements from these and other Canadian banks.

What will it take to get a Data Exchange Definition that will work?

I remember needing a developer to help build a Data Exchange Definition for another customer for Scotia Bank, and we didn’t want this to be a developer thing. The customer really wanted this to be something they could set up and manage changes for (if needed) themselves.

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here