PayTrace enhances Trace AR for Microsoft Dynamics 365 Business Central with new features and reporting

Note: This article is sponsored by PayTrace.

In a digital marketplace, automated payment processing can make or break a company's bottom line.

In a recent MSDW podcast, PayTrace's lead solutions engineer Carlton Ortega and product leader Jeremy Boogaart shared how the latest release of Trace AR is helping Dynamics 365 Business Central customers streamline accounts receivable tasks, reduce errors, and accelerate the reconciliation of incoming payments.

Revamping payment options and bank reconciliation

One noteworthy update is the introduction of Trace ACH, allowing customers to pay directly from their bank accounts.

"You can now also use our in-house ACH product," Boogaart said. "So if you want to have your customers pay by bank, that is now a possibility."

By supporting ACH payments alongside credit cards, Trace AR aims to cut transaction fees and broaden the range of payment methods available to D365BC users.

PayTrace also addressed a common bottleneck for finance teams by integrating a more robust bank reconciliation feature.

"We can grab the payment batches, the settlement batches, and compare those to your bank deposits," Boogaart explained.

This change aims to minimize manual data entry, significantly reduce errors, and help accountants close the books faster, especially when dealing with large volumes of daily transactions.

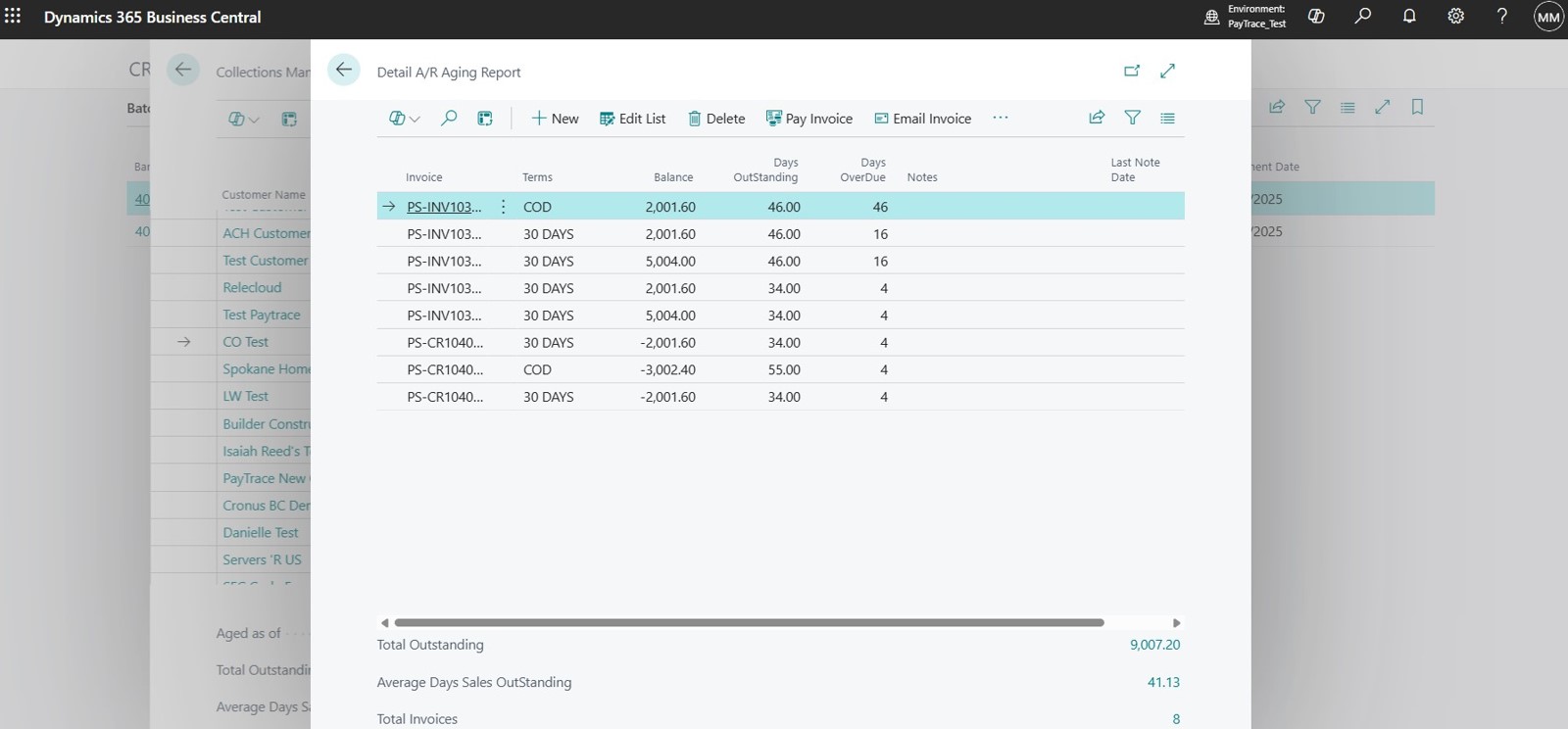

Empowering collections with a comprehensive AR aging report

Trace AR now includes a powerful AR aging report that Boogaart described as a "mini collections" tool.

"It really allows you to see all of your outstanding invoices . . . summarized by customer," he said, adding that merchants can resend invoices, accept payments, and collaborate on account details in one place.

This integrated approach gives finance professionals quick control over overdue invoices, while also offering a seamless way to maintain and document client communication.

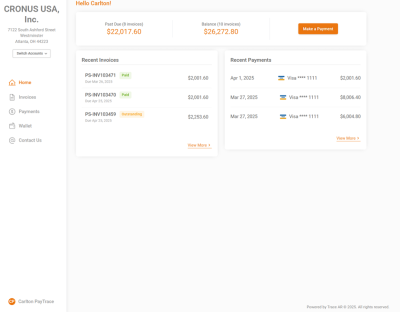

Enabling self-service through the client portal

Moving beyond internal improvements, PayTrace has introduced a dedicated client portal for end users to view and pay outstanding invoices.

"We can connect your Business Central instance to a portal . . . for your customers to log in and pay," Boogaart noted, underscoring the shift toward more convenient, online-first interactions.

By offering 24/7 accessibility, the portal alleviates some of the burden on AR teams who would otherwise spend valuable time fielding payment-related inquiries.

Implementation approach: A predictable journey coupled with white-glove support

When asked about the rollout experience, Ortega said that PayTrace follows a structured six-to-eight-week implementation plan to ensure a smooth setup for its early adopters, guiding them through each step.

"[Our] project plan goes through the solutioning, followed by the sandbox implementation into the production implementation, and of course, the post-go-live maintenance," Ortega said.

After launch, PayTrace provides ongoing support to ensure everything runs smoothly. Throughout the process, the company checks in with its customers weekly. The team is also available anytime if issues come up, according to Ortega.

"We essentially recognize ourselves as an extension of their team," he said. "They have direct access to us if anything goes wrong. They also have direct access to us to express any enhancements they're looking for or any features they might be missing. We essentially are just that end all, be all for them as they go through the implementation experience with us."

Roadmap and industry presence

While the current enhancements already address key AR pain points, Boogaart hinted at future developments focused on automating credit checks, handling advanced payment-blocking rules, and integrating with more e-commerce platforms.

Boogaart also highlighted additional enhancements in the pipeline, such as support for recurring sales, improved visibility into historical transactions, and greater efficiency in batch processing. He said these updates will continue to reduce manual oversight, making payments "a natural part of the process" rather than an added chore.

As for immediate plans, PayTrace will showcase its enhanced Trace AR solution at Microsoft Dynamics events, including the recent Directions North America in Las Vegas and the upcoming DynamicsCon in Chicago. The company views these events as opportunities to gather real-time feedback from partners and end users, ensuring that each new feature aligns with evolving market needs.

Conclusion

PayTrace continues to focus on making accounts receivable more efficient, more flexible, and less prone to errors. Whether it's ACH payments, bank reconciliation, AR aging reports, or a fully integrated client portal, the newly expanded Trace AR ecosystem offers a unified platform for AR processes, the team says. Ortega and Boogaart stressed that these updates, along with ongoing customer feedback, reflect PayTrace's commitment to "five-star support" and its continued focus on the real-world challenges of modern finance teams.

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here