Microsoft earnings inch up in 2022 Q4 as Azure growth decelerates

Microsoft announced 2022 Q4 earnings of $2.23 per share, up 3%. Revenue grew 12% to $51.9 billion with net income of $16.7 billion, up 2%.

CFO Amy Hood noted that Commercial bookings grew 25% and Microsoft Cloud revenue was $25 billion, up 28% year over year. The company’s earnings and revenue both missed average analyst estimates.

“No company is better positioned than Microsoft to help organizations deliver on their digital imperative – so they can do more with less,” stated Microsoft CEO Satya Nadella.

Some of the business highlights of Q4 in cloud and business applications include:

- Productivity and Business Processes revenue of $16.6 billion, up 13%

- Intelligent Cloud revenue of $20.9 billion, up 20%

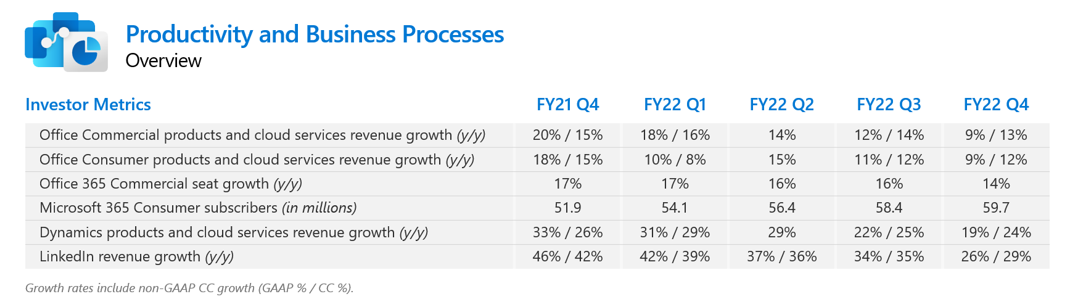

- Dynamics products and cloud services revenue increased 19% driven by Dynamics 365 revenue growth of 31%

- Azure and other cloud services revenue grew 40%

- LinkedIn revenue increased 26%

- Server products and cloud services revenue increased 22%

- Office Commercial products and cloud services revenue increased 9% (up 13% in constant currency) driven by Office 365 Commercial revenue growth of 15%

In Q3 2022, Azure and other cloud services revenue grew at 46%. In that quarter, Dynamics product and cloud service revenue rose 22%, with Dynamics 365 revenue growth of 35%

In Q4, commercial bookings grew 25% year-over-year, “driven by an increase in the number of larger, longer term Azure contracts and strong execution across our core annuity sales motions,” the company stated in its earnings materials. Microsoft Cloud gross margin decreased to 69%, the first time below 70% in the last 5 quarters.

For the full year of 2022, the company reported 18% revenue growth to $198.3 billion and EPS up 20% to $9.65 GAAP, beating an average estimate of $9.31.

The company noted the impact of a range of macroeconomic conditions, including unfavorable foreign exchange rates, the scale down of Russian operations increased employee severance expenses related to “strategic realignment of our business groups”.

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here