Tax Processing for Microsoft Dynamics 365

About This Solution

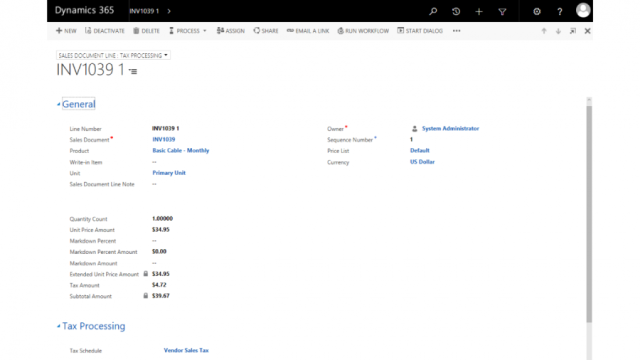

Rockton Software's Tax Processing application provides users with an automated approach to tax calculation directly inside Microsoft Dynamics 365 for Sales.

Tax processing lets you chose the settings that best fit your unique business needs. Establish custom tax calculations complete with tax schedules or utilize a built-in integration with Avalara's AvaTax*. The choice is yours, but the tax calculations are automatic.

Customizable Tax Calculation

Utilize the customizable tax calculation option of this app and taxes will be a breeze! Create tax details designed to capture the essentials of a given tax, such as tax amount or percentage. Easily group these tax details into tax schedules that can be assigned to sales documents, creating document taxes. Tax schedules will eliminate the manual entry that was previously required of users and greatly reduce errors.

Tax Integration with Avalara

Leverage the industry leading capabilities of Avalara's AvaTax product with our Tax Processing app. Say goodbye to the maintenance of tax details and tax schedules as AvaTax takes over, ensuring all tax data is current. This solution also offers cloud storage of taxes applied, easing the reporting process for taxes when year-end arrives. While you're at it, enjoy address validation against postal standards. *AvaTax integration requires a separate product license with Avalara.

FREE Membership Required to View Full Content:

Joining MSDynamicsWorld.com gives you free, unlimited access to news, analysis, white papers, case studies, product brochures, and more. You can also receive periodic email newsletters with the latest relevant articles and content updates.

Learn more about us here