Dynamics 365 Finance & Supply Chain (F&O): 2026 Innovations

Microsoft’s cloud ERP has seen major waves of new capabilities from 2024–26, with a heavy focus on AI/automation, integration, and global finance. Key highlights include:

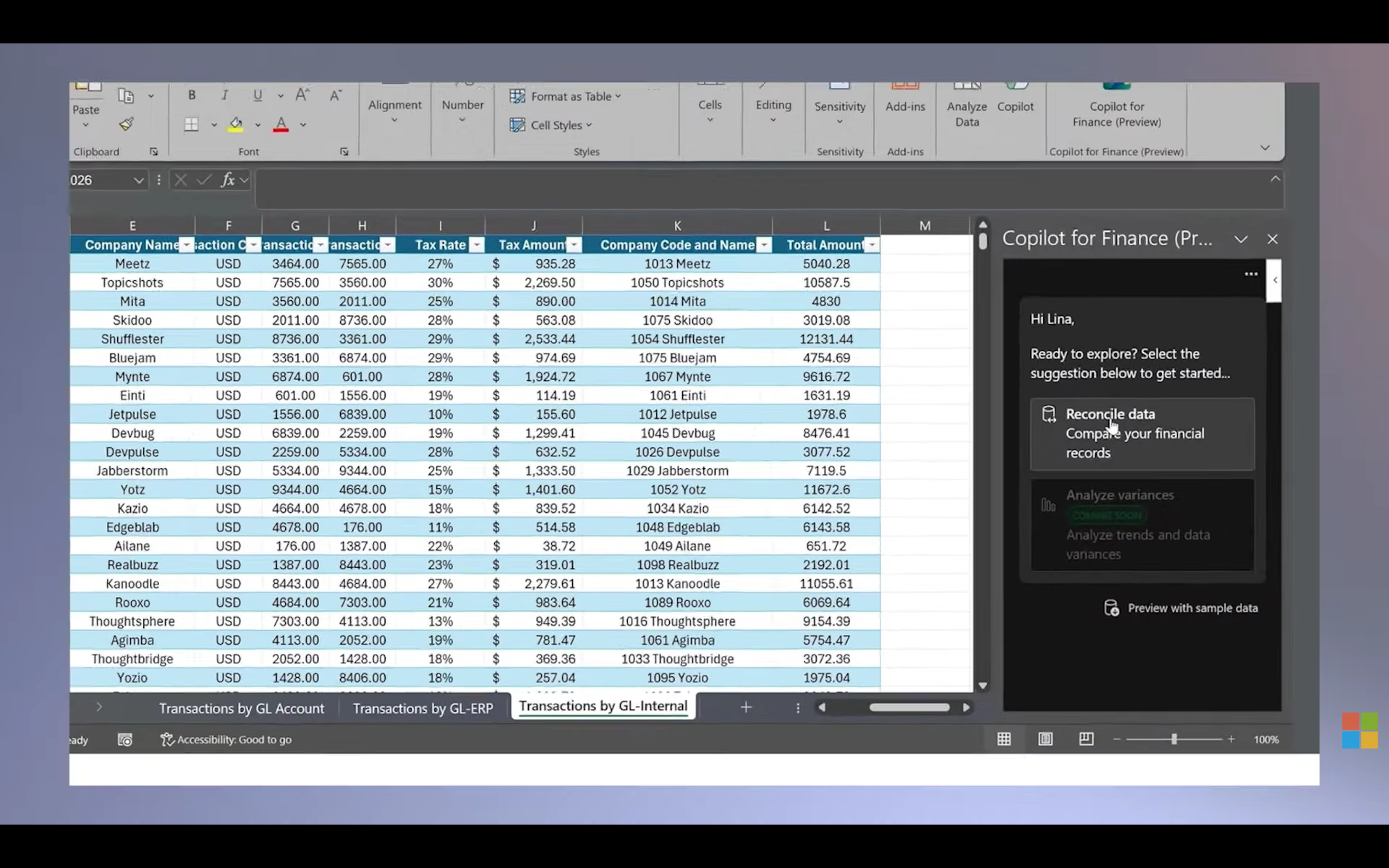

- AI-driven automation (Copilot): Copilot is now embedded across F&O: for example, AP clerks can use Copilot to correct receipt-matching errors on one screen, collections managers get an AI‑summarized “Collections Coordinator” workspace with customer credit/payment history, and planners can query demand forecasts or purchase-order impacts in natural language. Wave 2 adds Copilot in-app plugins that let organizations inject their own business logic (so Copilot can trigger custom actions across finance apps).

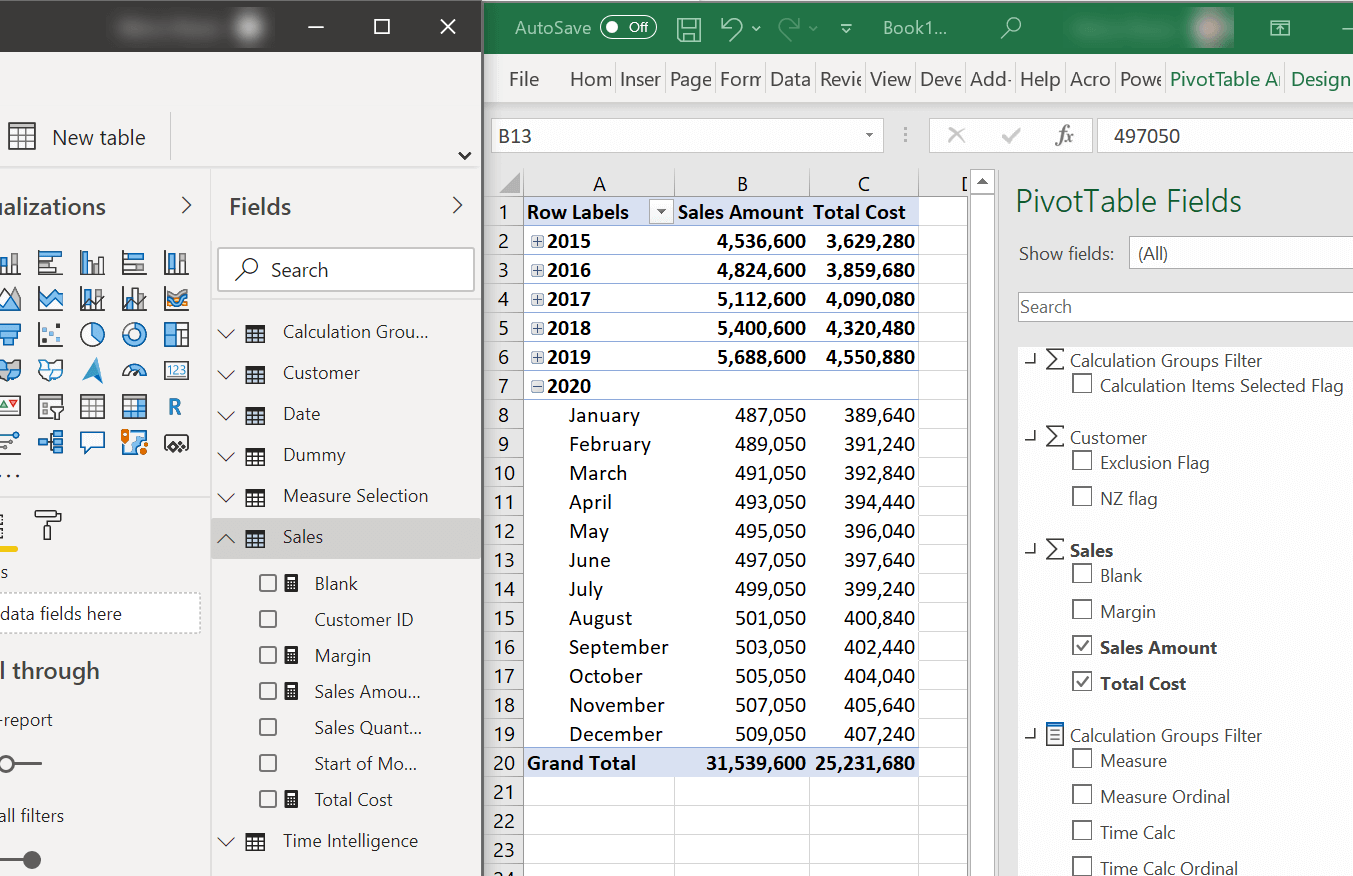

Data and integration enhancements: F&O now deepens its Microsoft ecosystem ties. The new Analyze in Excel and Power BI features deliver live access to F&O data (via Business Performance Analytics) for pivot-table analysis and dashboards.

Dual-write to Dataverse has been improved: asynchronous dual-write (bulk data sync) speeds up integrations to Dataverse without timeouts, and virtual entity performance has been enhanced so thousands of F&O tables can be exposed to Power Platform apps. Offline mobile support for virtual entities was also introduced (so field apps can work disconnected).

- Planning and Reporting: A new Business Performance Planning model (on Microsoft Fabric/Dataverse) lets finance teams build budgeting and forecasting models (dimensions and cubes) that write back through Power BI or Excel. This complements F&O’s real-time analytics – for example, embedded Power BI workspaces and “Analyze in Excel” ensure reports and KPIs always reflect up-to-date ledger balances. Core finance got enhancements too: an advanced bank reconciliation engine with snapshot-based reporting speeds up reconciliations, and general-ledger changes (like longer invoice numbers and new journal templates) improve control and scalability.

- Globalization and compliance: Microsoft continues expanding localization. By 2025 F&O will include out‑of‑box localizations for over 210 countries/regions with automatic tax and regulatory updates. For example, Wave 1/2 added new tax compliance for Turkey, Argentina and Malaysian e‑invoicing, and wider LATAM support. At the same time D365 F&O’s audit and policy framework has been strengthened: administrators can define audit policies that automatically check expense reports, invoices or POs against compliance rules, and every transaction has a full audit trail. Built-in controls (Segregation of Duties, audit history, secure workflows) and Microsoft’s cloud security (Azure AD, ISO/GDPR compliance) underpin F&O’s governance. As one consultant notes, F&O offers “advanced localization features for 40+ countries with deep tax and audit support” out of the box.

Overall, Dynamics 365 F&O’s 2024–25 release waves have delivered significant new capabilities: pervasive AI (Copilot) across finance and supply chain, deeper integration with Teams/Excel/Power BI/Outlook, and expanded global compliance. These innovations – especially Copilot-driven workflows and real-time analytics – distinguish it from its predecessors.

Integration with Microsoft Productivity Tools

F&O is tightly integrated with the Microsoft 365 stack. It provides native connectors to Power BI, Excel, Teams, and Outlook so that users can work in familiar interfaces while accessing ERP data. For example, the Analyze in Excel feature lets finance users open live F&O reports in Excel for pivot-table analysis (with automatic data refresh). In Teams, any user can link F&O records (customers, orders, etc.) to channels or chats and view/edit them without leaving the Teams client.

Microsoft’s new Copilot for Finance extends this further: accountants can stay in Outlook or Teams and still perform ERP tasks. For instance, Copilot can draft invoice-related emails or automatically log meeting follow-ups back into F&O.

<iframe width="560" height="315" src="https://www.youtube.com/embed/0sPGgLnwBv0?si=7wpqw1tmRdb54G0W" title="YouTube video player" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share" referrerpolicy="strict-origin-when-cross-origin" allowfullscreen></iframe>

In practice, this means finance staff rarely need to “log into ERP” – they can use Excel, Teams, or Outlook as their front end, with F&O data flowing transparently. By contrast, SAP and NetSuite require more separate tools or middleware to achieve similar connectivity.

Multi‑Entity Accounting, Intercompany & Global Compliance

Dynamics 365 F&O is designed for complex, multi-entity enterprises. It allows dozens or even hundreds of legal entities in one tenant, each with its own chart of accounts if needed, while also enabling global consolidation. Intercompany transactions can be automated end-to-end: F&O will auto-generate and post intercompany journal entries (such as a sale in one country creating a purchase in another), and will auto‑eliminate those balances during consolidation.

These processes are auditable and highly configurable. For example, D365 Finance can maintain separate ledgers or books for IFRS vs GAAP, apply localized posting rules per country, and handle intercompany matching in real time. Currency management is robust (supporting 170+ currencies) with automatic revaluation.

On compliance, F&O includes extensive built-in controls. Its Audit policy rules let administrators batch‑evaluate documents against custom criteria (e.g. flagging invoices over a certain amount). Workflow and role-based security ensure approvals and segregation of duties. Localization is another strength: Microsoft now offers over 42 country-specific localizations (tax tables, reporting formats, regulatory processes) as part of the core product, and updates them continuously. (By 2025 that scope extends – the product team announced new localizations for Turkey, Argentina, LATAM, Malaysia e-invoicing, etc..)

Enterprises with multi-country operations get strong out-of-box support in F&O for local tax rules, statutory reports, and audit requirements, reducing the need for custom extensions.

Compared to SAP S/4HANA and NetSuite: SAP’s global finance engine is very capable too, but it typically requires a portfolio of SAP solutions (like SAP Tax, SAP ARIBA, SAP Cloud Integration) to match F&O’s built-in breadth. NetSuite supports multiple subsidiaries and currencies, but Microsoft analysts note that D365’s multi-country tax and audit features are generally deeper.

For example, NetSuite lists support for 190+ currencies and localized tax rules, but relies on partners for many country‑specific legal requirements. By contrast, D365 F&O explicitly automates country regulations (through Globalization Studio) for over 210 jurisdictions, which is a compelling advantage for highly regulated, global enterprises.

Real-Time Reporting and Budgeting

Dynamics 365 F&O emphasizes live financial analytics. All transactional data flows in real time to its reporting engine (on Azure SQL/Power BI), so dashboards and financial statements are always up-to-date. The Business Performance Analytics suite (built on Microsoft Fabric) provides dimensional data models for Finance – the new Record-to-Report data model lets users slice/dice across entities, dimensions and period efficiently. Crucially, F&O tightly links with Excel/Power BI: for example, Finance users can export F&O data models into Excel pivots or Power BI charts and have them auto-refresh from the live ERP. This makes tasks like variance analysis, drill-down to sub-ledgers, and multi-entity roll-ups fast.

For budgeting and planning, D365 introduced Business Performance Planning (BPP). Using a cube-and-dimension approach, finance teams define planning models (for revenue, expenses, projects, etc.) and can enter or “write back” data through Power BI or Excel. This native planning layer supports multiple budget versions, what-if scenarios, and integrates with the general ledger for variance reporting. In practice, companies use this to do rolling forecasts, consolidated budgets, and scenario analyses across subsidiaries – all in one system.

F&O also upgraded its core budgeting controls. The new ledger journal framework allows very large multi‑company entries (hyper-scalable imports), and the bank reconciliation improvements save cash managers hours by automating matching and snapshots. Together, these give real-time visibility into budget vs. actuals and speed up period closes.

By comparison, SAP S/4HANA has powerful in-memory reporting (via HANA) but often requires SAP Analytics Cloud or other add-ons for budgeting and forecasting. SAP’s Financial Planning is modular and generally less integrated with its core ERP. NetSuite provides SuiteAnalytics and saved searches for reporting (near real-time), and has budgeting in the base product, but lacks the rich BI integration of Power BI/Copilot. Independent comparisons note that D365 leverages Microsoft’s BI/AI stack (Power BI, Copilot) for deeper real-time insights, whereas SAP and NetSuite rely on their own or third-party analytics tools.

Scalability and Intercompany Processing

Built as a modern cloud service on Azure, Dynamics 365 F&O is highly scalable. The platform supports thousands of concurrent users, large data volumes, and global performance SLAs. As one comparison notes, it offers “enterprise-grade scalability across global business units and geographies”. Customers can add new subsidiaries or regions without needing a separate instance (unlike older on-prem ERPs). The system’s intercompany engine, as mentioned, automates accounting across entities – real-time intercompany journals, automatic currency conversion, and elimination postings happen without manual intervention. This means a large conglomerate can roll up consolidated P&Ls and balance sheets on demand.

In head-to-head with NetSuite: both are cloud multi-tenant and scale with growing business, but D365’s use of Azure means it can leverage global data centers and enterprise resilience (e.g. Azure AD security, multi-region failover). NetSuite also scales, but some organizations find that heavy multi-subsidiary logic (tax differences, intercompany matching rules) is more mature in D365. SAP S/4HANA also scales to the largest enterprises, but customers often note that D365’s cloud-first architecture allows faster scaling and lower downtime (avoiding lengthy hardware provisioning). The SaaS upgrade model for D365/NetSuite (twice-yearly patching) ensures growth doesn’t stall on outdated software.

Licensing and Total Cost of Ownership

Dynamics 365 Finance & SCM is licensed as a subscription service (per user, per app). Microsoft offers flexible licensing – e.g. full “Finance” or “Supply Chain” licenses, or role-based Team Member licenses. Analysts point out that for large enterprises, D365’s subscription model can yield a lower 5‑year TCO than rival ERP, because there’s no big capital expense for servers or databases, and fewer extra “maintenance” fees. A 2025 comparison notes D365 Finance typically starts around $180/user/month, while SAP’s licensing (even with Rise) often comes to a much higher bill once hosting and consultancies are included. Both Oracle NetSuite and D365 use a modular subscription, but NetSuite’s pricing is often more opaque (with a platform fee plus per-module fees). In general, growing enterprises may find D365 more cost-effective at scale (especially if they already have Microsoft EA agreements), whereas NetSuite’s pricing is very predictable for mid‑market.

It’s also worth noting upgrade/maintenance: as a cloud service, D365 F&O receives major feature updates twice a year (via Microsoft’s Lifecycle Services) at no additional charge, similar to NetSuite’s automatic updates. This contrasts with on-prem S/4 implementations, where upgrades can be disruptive and expensive. Many enterprises appreciate that D365’s licensing bundles in Power Platform and common Office integrations, so they get more capabilities (e.g. Power BI embedding) without separate fees.

F&O vs. SAP S/4HANA vs. Oracle NetSuite: Key Differences

- Target market and maturity: D365 F&O is positioned for large global enterprises with complex operations, whereas NetSuite targets fast-growing mid-market firms and S/4HANA targets very large or highly regulated industries. All three offer core finance, but feature scope varies. D365 and S/4HANA both have comprehensive SCM, manufacturing and project modules; NetSuite’s built-in modules cover finance, CRM and basic supply chain, but often require SuiteApps or integrations for advanced manufacturing or eCommerce. As one analyst notes, companies with “lighter manufacturing needs” often prefer NetSuite, whereas “heavy manufacturing or multi-country operations typically align with Dynamics 365 F&O”. In specialized verticals (pharma, utilities, aerospace) SAP’s mature industry add-ons are hard to beat, but D365 is rapidly expanding its vertical capabilities too.

- Complexity and implementation: NetSuite is generally easiest to deploy (4–6 months for a standard multi-entity rollout) because it’s cloud-native from the ground up. D365 F&O implementations are typically longer (often 9–18 months) due to its breadth and customization options. SAP S/4HANA projects can be the longest (often 12–24 months or more) because of extensive business process mapping and possible on-prem infrastructure. In practice, D365 F&O is still complex (suitable for enterprises that can afford a dedicated project team), but many companies find it simpler than SAP. For example, Microsoft’s ecosystem means many firms already have Azure or O365 admins and can reuse in-house talent. By contrast, SAP typically demands specialized SAP consultants (especially for ABAP custom work). NetSuite’s lower complexity makes it attractive if you need speed and simplicity, but that comes at the expense of deep configurability.

- Customization and flexibility: D365 F&O shines on flexibility. It is built on the Microsoft Power Platform and Azure, so companies can create low-code apps and automation flows that tie into finance data. The ERP itself can be extended with custom fields, workflows and integrations via Dataverse. SAP S/4HANA allows deep customization through ABAP and SAP Business Technology Platform, but changes often require specialized skills and can slow upgrades. NetSuite has its SuiteCloud platform (SuiteScript, SuiteFlow), which is quite capable, but many note it has a higher technical barrier for bespoke logic. In UI/UX, D365 provides a modern, consistent experience (especially for Office users). NetSuite’s interface is considered intuitive and easy to use for basic workflows, while SAP’s Fiori UI is powerful but can be complex for new users.

- Analytics and AI: D365’s advantage is its integration with Microsoft’s analytics and AI stack. Power BI is embedded and Copilot (Azure OpenAI) is built into many F&O processes. NetSuite includes SuiteAnalytics with built-in dashboards and some machine learning (Oracle has announced AI features in analytics), but it’s not as tightly linked to Office. SAP S/4HANA can leverage HANA’s in-memory engine and SAP Analytics Cloud for analytics, but organizations often find D365’s out-of-the-box dashboards easier to set up.

- Licensing and TCO: D365 F&O and NetSuite both use SaaS subscriptions, but D365’s granular licensing (e.g. separate finance vs supply chain modules) and the ability to leverage existing Microsoft discounts can lower the five-year cost for large installations. SAP S/4HANA licensing often involves high upfront fees (even in cloud “Rise” bundles) and ongoing maintenance. Observers consistently note that Dynamics’ pricing is more transparent and generally more affordable for enterprises that fit its profile. For mid‑sized companies, NetSuite’s simpler subscription may be cheaper overall, but for a Fortune‑level rollout the flexibility of D365’s user‑based model (and Microsoft’s bundled Azure infrastructure) often wins on long-term TCO.

Why Enterprises Choose F&O Over SAP S/4HANA and NetSuite

Compared to SAP S/4HANA:

- F&O provides faster time to value and smoother upgrades via SaaS

- Copilot is embedded directly, while SAP AI tools often require separate modules

- Microsoft’s Power Platform offers unmatched low-code extensibility

Compared to Oracle NetSuite:

- F&O offers deeper localization, audit, and tax handling out of the box

- NetSuite is strong in the midmarket, but F&O is built for global scale

- F&O supports larger transaction volumes, more complex intercompany logic, and more advanced reporting

ERP Platform Comparison Table

| Feature Area | Dynamics 365 F&O | SAP S/4HANA | Oracle NetSuite |

| Multi-Entity Accounting | Built-in support for 100s of entities under one tenant | Supports multi-entity but often complex config | Supports subsidiaries, but less robust than F&O |

| Intercompany Automation | Real-time intercompany journals, auto-elimination | Possible with modules like Central Finance | Basic intercompany features; some automation |

| Localization Support | 210+ countries, automatic tax/localization updates | Strong but requires configuration and add-ons | Localized tax support; partner apps for full coverage |

| Audit & Compliance | Native audit policies, SoD, secure workflows | Comprehensive with GRC add-ons | Audit trails available, fewer native compliance tools |

| AI and Automation | Copilot across finance, AR, AP, collections | AI via SAP BTP; not as embedded | ML available; Copilot-style tools limited |

| Excel & Outlook Integration | Out-of-box Excel, Outlook, Teams, Power BI | Excel plugins available; Outlook less native | Some integrations; Excel works, Teams/Outlook limited |

| Real-Time Reporting | Live reports via Power BI, Fabric, Excel integration | Strong with HANA/SAC, but modular setup | SuiteAnalytics near real-time, fewer BI options |

| Budgeting & Forecasting | Business Performance Planning with live GL links | SAP Analytics Cloud or partner tools | Basic forecasting; limited multi-scenario planning |

| Scalability (Transaction Volume) | High - built on Azure for global load | Very high - designed for large global enterprises | Moderate - SaaS, good for mid-market loads |

| Implementation Complexity | Medium - faster than SAP, longer than NetSuite | High - often 12-24+ months with multiple tools | Low - fast setup, limited deep config |

| Power Platform / Extensibility | Yes - Power Platform, Dataverse, low-code apps | Yes - with ABAP/BTP, higher skill demand | Yes - SuiteCloud platform, more technical |

| Total Cost of Ownership | Lower vs SAP; scalable and bundled integration | Highest - especially with on-prem or RISE bundle | Lower upfront; can rise with add-ons and scaling |

Why Large, Multi-Entity Organizations Choose F&O

Enterprises with complex, multi-country finance needs often land on Dynamics 365 Finance & SCM for several reasons.

First, ecosystem synergy: companies already using Microsoft 365, Teams, Azure or Power BI can extend familiar tools into finance. As one analysis concludes, if you “already use Teams, Office 365, Power BI or Azure” and want built-in AI capabilities, “Dynamics 365 Finance is the smarter, more cost-effective choice”. In practice, CFOs appreciate having one vendor for ERP plus productivity software – a single sign-on, unified security model, and seamless data flows.

Second, continuous innovation: Microsoft’s biannual release cadence means F&O is always gaining new features (from AI agents to global tax updates) without needing a disruptive upgrade project. By contrast, SAP and Oracle customers often wait years for big innovations. Many finance leaders cite Copilot and AI-powered automation as game-changers that they simply don’t find (out-of-box) in SAP or NetSuite.

Third, global financial strength: D365 offers the end-to-end financial management that cross-border enterprises demand – including strong intercompany automation and consolidation. The platform’s breadth (covering finance, supply chain, manufacturing, retail, etc.) means one team can integrate planning and reporting globally. Analysts note that D365 excels in industries like manufacturing and distribution (where many global companies operate), and in these sectors its ROI can be higher due to improved efficiency and reduced legacy costs.

Finally, cost/performance balance: While SAP S/4HANA can scale to the absolute largest firms, many find that D365 hits the sweet spot for most global 2000 companies: enterprise-grade functionality without the outsized complexity and price tag. As one comparison puts it, D365 F&O “dominates when enterprise-scale customization, global operations, and deep integration with Microsoft tools are essential”. NetSuite, meanwhile, is often reserved for fast-growing divisions or smaller legal entities within a larger enterprise. Thus in a multi‑entity, multi‑country rollout (say, a manufacturing firm with dozens of subsidiaries), Dynamics 365 F&O is often chosen as the single global ERP – offering familiar interfaces for end users and robust cross‑entity finance capability for the back office.